CEOs, CFOs, High-Ticket Coaches, Doctors, Lawyers, Tax Pros, Architects, and Service-Based Business Owners who want to strategically manage their finances and cut taxes many times even down to ZERO—correctly and legally, ...

Are your federal tax payments over $35,000?

FINALLY A FRESH APPROACH

TO TAX SAVINGS

A Breakthrough Framework to Help High-Impact Pros Keep Up to 100%

of Their Tax Payments.

DATE

Wed

10-08-2025

TIME

3 Hours

ET: 10am to 1pm

OTHER TIME ZONES

PT: 7am to 10am

CT: 9am to 12pm

LOCATION

Zoom

Limited Time

After 30 years in the financial world, handling face-to-face IRS audits for both small businesses and multimillion-dollar brands, and personally preparing over 1,500 tax returns in my own Tax & Accounting Firm, I created my signature Quadrants to simplify the tax code and tax strategies, so your money stays where it belongs: -- with YOU.

Mindblowing Concept!

Very, very Valuable!

Eye Opener!

I Applaud You!

Real Tax Savings Does NOT Happen During Tax Season, It Happens During The "Wealth Season"--- Aug, Sep, & Oct. Time is very limited.

TAX TREASURE MASTERCLASS

Why hundreds of business owners have worked with Susan.

"I came to Susan Ker feeling really worried because I knew I was going to owe a lot in taxes after a big sale. As always, Susan stepped in with patience, kindness, and serious expertise. She didn’t just guide me—she educated me. She created a plan, gave me clear strategies, and helped me apply them step by step. She truly cares. Thanks to her guidance, I been saving a lot in taxes, this year I saved over $43,000—for me, that is huge.

She knows how to bring peace and direction when you need it most. I’m incredibly thankful for her support.

Liza L.

Real Estate Investor

"I was in the middle of one of the most fearful times of my life—a face-to-face IRS audit. I had tried to handle it on my own for a month, but the pressure was way too much. That’s when I found Susan Ker. From the moment she stepped in, everything changed. She took over the process with dedication, giving me the confidence that it was finally being handled the right way. Her expert guidance, calm, and commitment brought me peace in a season full of fear.

Susan helped me save a significant amount in taxes and penalties. But more than that—she helped me keep my sanity. She’s not just a tax expert… she’s someone you can truly trust when everything feels like it’s falling apart..

Debi V.

CEO-CFO Business Owner

"My experience with the process of filing the return with the IRS was a bit frustrating because sometimes I couldn't understand the process. It wasn't until I had the great opportunity to meet and work with Susan Ker. She was kind and patient enough to explain to me what the process consisted of and, most importantly, how to apply my income and my expenses and thus be able to receive a refund or reimbursement. Susan is a skilled professional who knows the A to Z of the tax world.

Always willing to look for the best options in your favor. I have a lot to thank you for!!"

Belisa M.

Human Service Consular

"I feel grateful to have worked with Susan Ker. Taxes is something I like to stay away from because it is frustrating. She helped me understand so much. She really is very knowledgeable about taxes, accounting and organization. It feels great to keep more of my money and know that everything is properly done. Working with Susan is awesome. She is kind and very patient. I felt I could ask any question I had. To me that is important.

Thank you, Susan for your easy-to-follow guidance and follow up. I really appreciate it a lot."

Ruth M.

Business Owner

"I've worked with other tax professionals, but I got sick from the frustration. Taxes is a big responsibility, and it can consume a big portion of our time if we let it. Finding Susan Ker was a match in heaven. I actually looked forward to working with her each time we got together. I felt like a big heavy weight was lifted out my back and specially my mind. I learned so much and I got better organized. I am not worried any more if I am overpaying taxes or doing things wrong.

I am not worried anymore for my 2 teenagers because I can better help them. Thank you, Susan for helping me save money and keep my sanity."

Rebeca C.

CEO-CFO Business Owner

You’re the one who pays the taxes — so you need the power to lower it. You deserve to understand how it work. It’s time to take a stand for your wealth with a custom made Tax Savings Blueprint— the missing part between what you earn and what you keep.

TAX TREASURE MASTERCLASS

FINANCIAL CONFUSION BRINGS CHAOS, FINANCIAL CLARITY UNVEALS TAX SAVINGS.

YOUR PATH TO TAKEOVER TAXES BEGINS HERE!.

In this 3 Simple Steps Tax Treasure Masterclass you will discover my

signature process to lower taxes up to 100% if your

tax payment is $35K or more,...

1

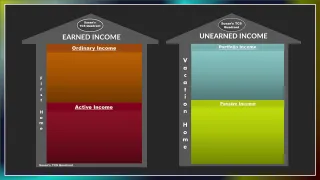

1. TAX CODE QUADRANT

Get access to my proven system that makes the tax code simple to understand — so you can see how it really works for business owners. This eliminate the fear of doing taxes wrong.

2

2. TAX TREASURE QUADRANT

Imagine finally seeing all the deductions, planning, strategies and advance strategies in a simple and understandable quadrant? Tax truth is tax clarity and it sets you free to lower your taxes.

3

3. TAX SAVINGS BLUEPRINT

See how it works and watch a case study of how a coach who we will name Davis saved a massive $116,907 in taxes— using the very strategies you’ll see in this masterclass.

This is an extensive customized tax strategy plan for your business to save many times up to 100% if you pay $35K or more.

After financial information is collected, you will have it ready within 1 to 3 weeks.

Meet Your Host, Susan Ker, EA.

Susan Ker

She is a faith driven IRS Enrolled Agent and Tax & Wealth Strategist, known as the Mastermind of Wealth Organization and creator of The Susan's Tax Quadrants.

As founder of Wealth Takeover Inc., she provides tax organization, up to 100% tax savings strategies, and bilingual tax training (Spanish & English). She helps 6–8 figure service-based entrepreneurs, doctors, lawyers, architects, real estate investors, tax pros, and coaches save time and hundreds of thousands in taxes.

Decades of Financial Experience

With over 30 years in the financial world—first as a bank manager, then founder of a successful tax firm, and as an IRS Enrolled Agent—she believed she had found her forever path.

She helped 5 to 8 figure clients save time, thousands of dollars, and survive intense in-person IRS Audits… until she saw what happened to the ones who came too late. One man said, “The IRS ate me alive. I wanted to hide under their desk. ” Another collapsed from stress and was rushed to the hospital. A marriage ended. Two businesses shut down under audit pressure. It wasn’t just about money anymore. It was about lives falling apart.

The Turning Point

That was her breaking point. She realized her mission was no longer to defend, but to help business owners rise and reclaim their wealth by lowering their tax bill. So she returned to the tax jungle—this time equipped to clear the path.

The Mission Was Born

She launched a YouTube channel, was a keynote speaker, sold her tax firm, created hands-on trainings, published the Tax Jungle Magazine, and founded The Wealth Takeover Trainings in English and Spanish—a mission to help business owners prevent chaos before it starts.

Faith Meets Strategy

Today she equips entrepreneurs to protect their time and slash taxes so they can build lasting wealth more efficiently. Her work blends bold faith, divine inspiration, elite mentorship from top-tier coaches, three decades of real-world financial wisdom, and proven strategies.

She’s Not Here to Save You—She’s Here to Empower You to Be Your Own Wealth Hero

She teaches what she always wished every entrepreneur knew before it was too late.

Do It NOW!

Less stress. More peace. Bigger impact.

THIS TRAINING IS PERFECT FOR

A HIGH IMPACT LIFE OR HEALTH COACH

You pour your heart to your clients, your calendar is full of meetings and masterclasses, but behind the scenes, your finances need you, and you're losing thousands in taxes.

A DOCTOR, LAWYER, ARCHITECT FIRM OWNER

You give your best to your clients, but while you’re busy serving them, your finances & tax bill often get neglected. Stop pushing it for later.

AN ENTREPRENEUR, VISIONARY, INVESTOR OR SERVICE BASED BUSINESS OWNER

You focus on making a difference for others, but financial chaos is sneaking in very fast and tax confusion is eating your cash flow.

What if In One Single Masterclass You Finally Gain the Revelation, Confidence and Breakthrough to Keep What You'd usually give the IRS?

Talk with Susan as she takes you on a adventure to unlock the old, ancient entrance to the chronicles of tax savings to keep your hard-earned money- the fun & legal way!

In this Masterclass you will discover Susan's two most powerful quadrants that helped 6 to 8-figure CEOs slash taxes —so you can grow wealth faster, with peace of mind.

Unlock more wealth to accelerate your financial freedom with clarity and simplicity.

> It's time to stop being afraid of the numbers- and start using them as your wealth flow.

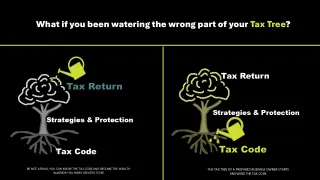

> It’s time we stop watering the leaves -(just doing tax returns)—and start nourishing the

roots- (Meaning understanding the tax code and tax strategies)

> It’s time to stop blindly following accountants—& start lovingly leading them as your Profit Protection Partner

or find the one will take you to the promise land of lower to zero taxes.

Here’s the truth: when you understand how the tax code really works, you gain the power to slash your taxes with tax strategies before the IRS takes from you.

Real tax savings come from preparation, not procrastination.

Gets This Tax Magazine Totally FREE!

Instantly after Securing your free seat.

YOU SHALL KNOW THE TAX TRUTH AND THE TAX TRUTH SHALL SET YOU FREE!

This is not just another magazine, this has the CODE and the best tax strategies that gives you ZERO Tax now and ZERO tax later. Tax Jungle Takeover Magazine helps business owners frustrated by taxes eliminate financial confusion instead of their business.

Easy to read on your phone, iPad, or computer.

IT'S TIME TO ELIMINATE FEAR WITH CLARITY

I’m not here to save you from the IRS — I’m here to hand over the tax treasure map so you to never need saving. I’m here to unleash the superhero power you already possess to protect your wealth.

> It’s time to stop fighting the wrong enemy (the IRS). An enemy not identified cannot be defeated.

> It’s time to stop tax complexity and start using it as your treasure map.

> It’s time to stop tax fear in its tracks with Tax Truth, Tax Strategies and a clear Tax Savings Blueprint.

The path to your tax treasure is guarded by fear, confusion, & chaos— seemingly powerful forces that seek to rob you of your wealth. To emerge victorious, we will use 2 powerful quadrants and the treasure of long term financial freedom will be yours.

Victory belongs to those who see what the IRS sees and understands it.

Frequently Asked Questions

I’m already so busy—how can I justify taking half a day off for this?

A: If you keep pushing tax planning aside, your next tax bill will look just like the last one—unless you made more money, then it’ll be even higher. This training gives you the power to finally understand the U.S. tax system and see the menu of deductions available to you. That knowledge can drastically reduce your tax bill—not just this year, but for many years to come. You’re not just doing it for yourself, but also for your family’s financial future.

I’ve tried learning about taxes before, but it never clicked—what makes this training actually work?

A: 1. You will learn the US Tax Code from scratch: Using my signature Tax Code Quadrant, you’ll see the truth of how taxes really work—simplified, visual, and color-coded. No one else teaches it this way. I know this because it took me years to assemble this quadrant.

2. You will discover a unique menu of deductions: My second signature, Tax Treasure Quadrant, shows deductions in an organized way like a menu. It displays all available deductions so you can pick, choose, and follow a clear path—like having a directory in a mall, but for tax deductions.

3. You will see a sample Tax Savings Blueprint: I’ll show you a unique, step-by-step process for building a tax savings blueprint that works for your business and finances.

4. The impact will forever change the way you see taxes: This isn’t just for one tax season—it’s for your wealth, your business, and your family’s finances for years to come.

I’m not a business owner—can I still attend, and will this training be relevant to me?

A: This class is perfect for individuals paying $35,000, $350,000 or more in taxes. It’s designed for professionals earning a W-2 as employees, as well as U.S.-based business owners and service-based entrepreneurs. Ideal participants include high-impact coaches, doctors, lawyers, architects, advisors, consultants, youtubers, course creators, and visionaries offering a service. This training is specifically for individuals and businesses operating in the U.S. (It’s not for foreign businesses or non-U.S. residents.)

Is this just hype and mindset talk, or will I actually learn practical tax strategies I can use right away?

A: No, this isn’t hype. These teachings come from 30 years in the financial industry and extensive research that has been simplified, optimized, organized, and refined over 100 times—after processing more than 1,500 tax returns in my own firm and successfully representing 6- to 8-figure business owners in IRS and state audits.

The goal is clarity. Think of a tree: the leaves represent filing your tax return, the trunk represents tax strategies, but the roots represent the U.S. Tax Code. This class starts with the roots, then moves to strategies—so professionals and business owners can finally understand the foundation of the system, not just surface-level tactics. It’s a practical class where you’ll want pen and paper ready.

To prepare you even more, you’ll instantly receive a free tax magazine after registering that explains the U.S. Tax Code in plain English. You’re not just learning “tips”—you’re learning the root system that empowers you to lower taxes with clarity and confidence year after year.

Legal Disclaimer

The information provided in this training is based on extensive professional research in the fields of taxes and accounting. However, we do not guarantee specific results, including your ability to achieve financial success or save money using our strategies. Your results will depend entirely on your time, effort, energy, and commitment. Success in business requires a solid plan, a strong work ethic, and perseverance in the face of challenges.

This training is intended to offer you a sample of what our full program includes. All relevant information is detailed in our terms, privacy policies, and legal disclaimers, available through the links on this page. If you share our practical vision of the business world and understand that reaching valuable goals requires effort and consistency, we’re confident this program is ideal for you. It will be an honor to accompany you on your path to success.

Enjoy the training!